From Wall Street’s Dirt Road to Your First Paycheck: A Guide for Future Investors

- Aug 27, 2025

- 5 min read

![Teaching Kids, Teens, and Young Adults the Value of Money

By Chase Fowler, CFP®, Financial Advisor

Teaching Kids, Teens, and Young Adults the Value of Money

Understand how to be a disciplined investor (pay yourself first)

Understand the cost of debt and don’t let debt stop you from your investing goals

Start as soon as possible—if you start earlier your future self will thank you

⸻

My kids have recently become aware that pretty much everything in life costs money. They are regularly asking me how much something costs—from ice cream cones to homes. You can see their wheels turn when I explain how much money it costs to buy something like a house. For example, the current median home price in the U.S. as of May 2025 is $462,206. I can see the confusion on their faces, as they wonder how it’s even possible to buy something that expensive.

This isn’t just a lesson for young kids. Teenagers, college students, and those in their early 20s are faced with even bigger financial decisions: student loans, buying their first car, paying rent, or even starting to save for retirement. These choices can shape long-term financial habits.

While, on a day-to-day basis, we manage our client’s retirement investments, we also understand most of us have people around us—kids, mentees, young family members—that we hope will be successful in life. Not only from a place of health, satisfaction, and happiness, but also that they will be able to reach financial independence by making disciplined decisions over the long term.

Tony Reilly, CEO, Ascend Advisory recently shared more thoughts on this idea of mentoring young people here: Helping Youth Think About Money and Investing.

Wall Street: A 400-Year Story

Wall Street: A 400-Year Story

Did you know the concept of a stock market exchange in the U.S. started over 400 years ago on the dirt road in lower Manhattan we now call Wall Street? People came together to trade goods. Others made it difficult to trade, so a wall was constructed to keep them out. Hence the name: Wall Street.

Bulls, Bears, and Market Movements

A bull market is a term that represents a market where prices of stock are rising and a bear market is a term for a falling market. But do you know where the terms came from?

Bull & bear markets originate from the visual of a bear fights by using his paws in a downward motion, and a bull fights by moving his horns in an upward fashion.

This or That? Spend vs. Invest

Setting aside a minimum of 10% of your income to invest will set you up for success in the long run.

Every time you receive income, you should pay yourself first. What does that mean? Setting aside a minimum of 10% of your income to invest will set you up for success in the long run. We are all tempted to begin spending it on other items though. Instead of paying ourselves first, most people will be tempted to purchase something for themselves.

Buying Apple iPhone in 2007 cost versus investing in the Nasdaq 100

[PLACEHOLDER: CHART]

Buying Air Jordans in 2007 versus investing in the S&P 500

[PLACEHOLDER: CHART]

These charts show the decisions we can make every day. We can choose to purchase items that have initial value, but ultimately depreciate over time, or we can make sure that a portion of our income is going towards savings that compound over time.

Understanding Debt Before It Understands You

When you leave home and throughout adulthood, you’ll be faced with the option of using debt regularly. Taking out student loans, buying your first car, using a credit card, and buying your first home will all be decisions you’ll be faced with. While debt is sometimes necessary, it’s important to understand whether the cost is worth it for you. It’s especially important to consider if taking on debt stops you from investing altogether.

In the chart below, we’ll look at buying a new vehicle for $40,000 with a 7% interest rate. We’ll show you paying off this loan for 10 years, compared to investing the same monthly amount in investments. Instead of a 7% interest cost, we’ll show a 7% annualized return on the investment over the same 10-year period.

[PLACEHOLDER: CHART]

In summary, this example shows the opportunity cost missed by choosing the debt option.

The $40,000 vehicle cost $55,732.07 with the interest cost.

If we had taken the same monthly payment amount and invested it at 7% returns, you would have ended up with $80,855.38.

While debt is sometimes necessary—you need to buy a car or a home—as investors we must constantly be evaluating the long-term cost of money spent versus money invested.

The Cost of Waiting

In all of life, there is always the temptation of the present. Having excess cash on hand, it may be tempting to hold on to it or use it to purchase something you want. These choices aren’t inherently wrong, as long as they don’t stop you from paying yourself first.

Below, the chart shows a retirement savings goal of $2,000,000 for someone retiring at 65.

The plan will assume a 7% growth rate of the savings,

and the right columns will show you how much you would need to save on an annual basis to reach $2,000,000 at that growth rate.

We have set the start age for different decades, showing the cost required annually if someone chooses to wait to begin investing.

[PLACEHOLDER: CHART]

As you can observe, the longer someone waits to begin investing the more savings is required annually.

Someone starting at age 20 would need to save $6,999.14 annually

and someone beginning at age 40 would need to save $31,621.03 annually.

This creates a situation where someone may need to save much more than 10% of their income or take too much risk in their portfolio to try to play catch-up.

Now let’s look at the same situation, but from a different lens. Let’s say someone chooses to save, but they keep it in a conservative savings vehicle earning only 2% annually long term.

[PLACEHOLDER: CHART]

We can see that just by changing the long-term return from 7% to 2%, the annual savings amount beginning at age 20 jumps from $6,999.14 a year to $27,819.23. This shows us that it’s not just savings that is the goal, but investing your savings, with appropriate risk, for the long term.

There are many complexities to investing. If you stay disciplined, save regularly, and let compound interest do its work over time you will see the power of the markets in your own life.

Regarding specific questions, plans, or the types of accounts or investments you should begin with, please reach out to your financial advisor to go over your plan. If you have someone in your life that would benefit from this information, feel free to share this article with them along with our information.

*The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value.](https://static.wixstatic.com/media/11062b_0c9de7425ec144c2b5df1dbb7184cc8f~mv2.jpeg/v1/fill/w_980,h_653,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/11062b_0c9de7425ec144c2b5df1dbb7184cc8f~mv2.jpeg)

By Chase Fowler, CFP®, Financial Advisor

Teaching Kids, Teens, and Young Adults the Value of Money

Understand how to be a disciplined investor (pay yourself first)

Understand the cost of debt and don’t let debt stop you from your investing goals

Start as soon as possible—if you start earlier your future self will thank you

⸻

My kids have recently become aware that pretty much everything in life costs money. They are regularly asking me how much something costs—from ice cream cones to homes. You can see their wheels turning when I explain how much money it costs to buy something like a house. For example, the current median home price in the U.S. as of May 2025 is $462,206. I can see the confusion on their faces, as they wonder how it’s even possible to buy something that expensive.

This isn’t just a lesson for young kids. Teenagers, college students, and those in their early 20s are faced with even bigger financial decisions: student loans, buying their first car, paying rent, or even starting to save for retirement. These choices can shape long-term financial habits.

While, on a day-to-day basis, we manage our client’s retirement investments, we also understand most of us have people around us—kids, mentees, young family members—that we hope will be successful in life. Not only from a place of health, satisfaction, and happiness, but also that they will be able to reach financial independence by making disciplined decisions over the long term.

Tony Reilly, CEO, Ascend Advisory recently shared more thoughts on this idea of mentoring young people here: Helping Youth Think About Money and Investing.

Wall Street: A 400-Year Story

![Teaching Kids, Teens, and Young Adults the Value of Money

By Chase Fowler, CFP®, Financial Advisor

Teaching Kids, Teens, and Young Adults the Value of Money

Understand how to be a disciplined investor (pay yourself first)

Understand the cost of debt and don’t let debt stop you from your investing goals

Start as soon as possible—if you start earlier your future self will thank you

⸻

My kids have recently become aware that pretty much everything in life costs money. They are regularly asking me how much something costs—from ice cream cones to homes. You can see their wheels turn when I explain how much money it costs to buy something like a house. For example, the current median home price in the U.S. as of May 2025 is $462,206. I can see the confusion on their faces, as they wonder how it’s even possible to buy something that expensive.

This isn’t just a lesson for young kids. Teenagers, college students, and those in their early 20s are faced with even bigger financial decisions: student loans, buying their first car, paying rent, or even starting to save for retirement. These choices can shape long-term financial habits.

While, on a day-to-day basis, we manage our client’s retirement investments, we also understand most of us have people around us—kids, mentees, young family members—that we hope will be successful in life. Not only from a place of health, satisfaction, and happiness, but also that they will be able to reach financial independence by making disciplined decisions over the long term.

Tony Reilly, CEO, Ascend Advisory recently shared more thoughts on this idea of mentoring young people here: Helping Youth Think About Money and Investing.

Wall Street: A 400-Year Story

Wall Street: A 400-Year Story

Did you know the concept of a stock market exchange in the U.S. started over 400 years ago on the dirt road in lower Manhattan we now call Wall Street? People came together to trade goods. Others made it difficult to trade, so a wall was constructed to keep them out. Hence the name: Wall Street.

Bulls, Bears, and Market Movements

A bull market is a term that represents a market where prices of stock are rising and a bear market is a term for a falling market. But do you know where the terms came from?

Bull & bear markets originate from the visual of a bear fights by using his paws in a downward motion, and a bull fights by moving his horns in an upward fashion.

This or That? Spend vs. Invest

Setting aside a minimum of 10% of your income to invest will set you up for success in the long run.

Every time you receive income, you should pay yourself first. What does that mean? Setting aside a minimum of 10% of your income to invest will set you up for success in the long run. We are all tempted to begin spending it on other items though. Instead of paying ourselves first, most people will be tempted to purchase something for themselves.

Buying Apple iPhone in 2007 cost versus investing in the Nasdaq 100

[PLACEHOLDER: CHART]

Buying Air Jordans in 2007 versus investing in the S&P 500

[PLACEHOLDER: CHART]

These charts show the decisions we can make every day. We can choose to purchase items that have initial value, but ultimately depreciate over time, or we can make sure that a portion of our income is going towards savings that compound over time.

Understanding Debt Before It Understands You

When you leave home and throughout adulthood, you’ll be faced with the option of using debt regularly. Taking out student loans, buying your first car, using a credit card, and buying your first home will all be decisions you’ll be faced with. While debt is sometimes necessary, it’s important to understand whether the cost is worth it for you. It’s especially important to consider if taking on debt stops you from investing altogether.

In the chart below, we’ll look at buying a new vehicle for $40,000 with a 7% interest rate. We’ll show you paying off this loan for 10 years, compared to investing the same monthly amount in investments. Instead of a 7% interest cost, we’ll show a 7% annualized return on the investment over the same 10-year period.

[PLACEHOLDER: CHART]

In summary, this example shows the opportunity cost missed by choosing the debt option.

The $40,000 vehicle cost $55,732.07 with the interest cost.

If we had taken the same monthly payment amount and invested it at 7% returns, you would have ended up with $80,855.38.

While debt is sometimes necessary—you need to buy a car or a home—as investors we must constantly be evaluating the long-term cost of money spent versus money invested.

The Cost of Waiting

In all of life, there is always the temptation of the present. Having excess cash on hand, it may be tempting to hold on to it or use it to purchase something you want. These choices aren’t inherently wrong, as long as they don’t stop you from paying yourself first.

Below, the chart shows a retirement savings goal of $2,000,000 for someone retiring at 65.

The plan will assume a 7% growth rate of the savings,

and the right columns will show you how much you would need to save on an annual basis to reach $2,000,000 at that growth rate.

We have set the start age for different decades, showing the cost required annually if someone chooses to wait to begin investing.

[PLACEHOLDER: CHART]

As you can observe, the longer someone waits to begin investing the more savings is required annually.

Someone starting at age 20 would need to save $6,999.14 annually

and someone beginning at age 40 would need to save $31,621.03 annually.

This creates a situation where someone may need to save much more than 10% of their income or take too much risk in their portfolio to try to play catch-up.

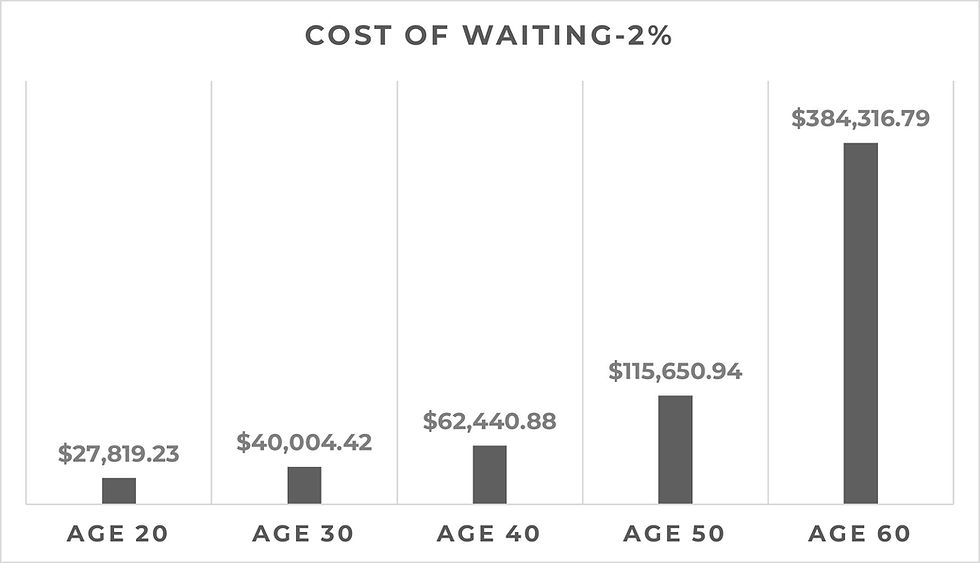

Now let’s look at the same situation, but from a different lens. Let’s say someone chooses to save, but they keep it in a conservative savings vehicle earning only 2% annually long term.

[PLACEHOLDER: CHART]

We can see that just by changing the long-term return from 7% to 2%, the annual savings amount beginning at age 20 jumps from $6,999.14 a year to $27,819.23. This shows us that it’s not just savings that is the goal, but investing your savings, with appropriate risk, for the long term.

There are many complexities to investing. If you stay disciplined, save regularly, and let compound interest do its work over time you will see the power of the markets in your own life.

Regarding specific questions, plans, or the types of accounts or investments you should begin with, please reach out to your financial advisor to go over your plan. If you have someone in your life that would benefit from this information, feel free to share this article with them along with our information.

*The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value.](https://static.wixstatic.com/media/4d2ad5a6300843d1bb5952efa6729423.jpg/v1/fill/w_980,h_651,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/4d2ad5a6300843d1bb5952efa6729423.jpg)

Did you know the concept of a stock market exchange in the U.S. started over 400 years ago on the dirt road in lower Manhattan we now call Wall Street? People came together to trade goods. Others made it difficult to trade, so a wall was constructed to keep them out. Hence the name: Wall Street.

Bulls, Bears, and Market Movements

A bull market is a term that represents a market where prices of stock are rising and a bear market is a term for a falling market. But do you know where the terms came from?

Bull & bear markets originate from the visual of a bear fighting by using his paws in a downward motion, and a bull fighting by moving his horns in an upward fashion.

This or That? Spend vs. Invest

Every time you receive income, you should pay yourself first. What does that mean? Setting aside a minimum of 10% of your income to invest will help set you up for success in the long run. We are all tempted to begin spending it on other items though. Instead of paying ourselves first, most people will be tempted to purchase something for themselves.

Buying Apple iPhone in 2007 cost vs. investing in the Nasdaq 100

This chart shows the decisions we can make every day. We can choose to purchase items that have initial value, but ultimately depreciate over time, or we can make sure that a portion of our income is going towards savings that compound over time.

Understanding the True Cost of Debt

When you leave home and throughout adulthood, you’ll be faced with the option of using debt regularly. Taking out student loans, buying your first car, using a credit card, and buying your first home will all be decisions you’ll be faced with. While debt is sometimes necessary, it’s important to understand whether the cost is worth it for you. It’s especially important to consider if taking on debt stops you from investing altogether.

In the chart below, we’ll look at buying a new vehicle for $40,000 with a 7% interest rate. We’ll show you paying off this loan for 10 years, compared to investing the same monthly amount in investments. Instead of a 7% interest cost, we’ll show a 7% annualized return on the investment over the same 10-year period.

$40,000 - Spending on a car loan (left) vs. investing in the stock market (right)

In summary, this example shows the opportunity cost missed by choosing the debt option.

The $40,000 vehicle cost $55,732.07 with the interest cost.

If we had taken the same monthly payment amount and invested it at 7% returns, you would have ended up with $80,855.38.

While debt is sometimes necessary—you need to buy a car or a home—as investors we must constantly be evaluating the long-term cost of money spent versus money invested.

The Cost of Waiting

In all of life, there is always the temptation of the present. Having excess cash on hand, it may be tempting to hold on to it or use it to purchase something you want. These choices aren’t inherently wrong, as long as they don’t stop you from paying yourself first.

Below, the chart shows a retirement savings goal of $2,000,000 for someone retiring at 65.

The plan will assume a 7% growth rate of the savings,

We have set the start age for different decades, showing the cost required annually if someone chooses to wait to begin investing.

The longer someone waits to begin investing the more savings is required annually. This creates a situation where someone may need to save much more than 10% of their income or take too much risk in their portfolio to try to play catch-up.

The amount of equal annual saving installments you need to put away to hit $2M at 65 - starting at age 20, 30, 40, 50 and 60. That's with a 7% annual return.

Now let’s look at the same situation, but from a different lens. Let’s say someone chooses to save, but they keep it in a conservative savings vehicle earning only 2% annually.

The amount of equal annual saving installments you need to put away to hit $2M at 65 - starting at age 20, 30, 40, 50 and 60. That's with a 2% annual return.

We can see that just by changing the long-term return from 7% to 2%, the annual savings amount beginning at age 20 jumps from $6,999 a year to $27,819. It’s not just savings that is the goal, but investing your savings with appropriate risk for the long term.

There are many complexities to investing. If you stay disciplined, save regularly, and let compound interest do its work over time you should see the power of the markets in your own life.

Regarding specific questions, plans, the types of accounts or investments you should begin with, please reach out to your financial advisor to go over your plan. If you have someone in your life that would benefit from this information, feel free to share this article with them.

*The NASDAQ 100 is an unmanaged group of the 100 biggest companies listed on the NADAQ Composite Index. The list is updated quarterly and companies on this Index are typically representative of technology-related industries, such as computer hardware and software products, telecommunications and biotechnology and retail/wholesale trade.

*The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value.

PM-02182027-8308503.1.1

.png)